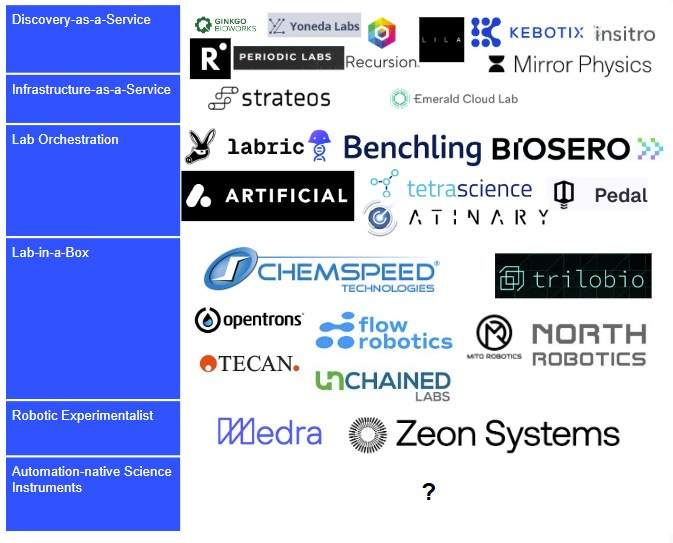

The Lab Automation Startup Ecosystem

A Market Map and What's Missing

Lab automation is beginning to attract a growing wave of startups. After years of academic prototypes and institutional research, it’s exciting to see more founders and investors enter the space — building companies that combine robotics, software, and AI to accelerate scientific discovery.1

As with any emerging field, the optimal firm boundaries are still in flux and a powerful direction of experimentation.2 Startups are experimenting not only with new technologies, but with new business models — staking out different positions across the lab automation value chain in search of where value accrues and how best to capture it.

This post maps the current landscape of lab automation startups, organized by the strategic archetypes they represent. It also highlights one critical gap and a thesis I believe is increasingly important to the future of the field.

Discovery-as-a-Service

Example Companies: Ginko Bioworks, Radical AI, Zymergen (acq by Ginko), Recursion, Lila Sciences, Insitro, Periodic Labs, Yoneda Labs

These companies bundle lab automation infrastructure with in-silico methods to operate full-stack discovery pipelines. Rather than selling tools or infrastructure, they aim to capture value by directly commercializing or licensing the discoveries their platforms generate.

The core challenge is that discovery and commercialization often involve fundamentally different competencies. While there’s a well-established model for commercializing scientific discoveries, it’s less clear how to directly monetize the acceleration of discovery itself. These companies not only carry the high CapEx of building lab automation infrastructure, but also take on the scientific and commercial risk of identifying which discovery programs are most viable.

The likely best in-road here is biotech, where there is a clear process for commercializing discoveries and where there are some new firms (likely not all listed) who are adding in lab automation to their workflows.

Infrastructure-as-a-Service

Example Companies: Strateos, Emerald Cloud Lab

Rather than capturing value through discoveries themselves, lab automation IaaS companies provide remote access to automated lab infrastructure. These “cloud labs” allow researchers to design and execute experiments virtually without physically entering a lab.

While this model lowers barriers to scientific experimentation, it still demands significant CapEx to build and maintain fully automated lab environments. Moreover, because most scientific instruments were not designed for programmatic control, achieving true end-to-end automation remains difficult. In practice, many of these platforms still rely on human technicians behind the scenes, abstracted away from the user interface.

Lab Orchestration Software

Example Companies: Labric, Tetrascience, Benchling Connect, Artificial, Biosero, Pedal AI, Atinary

Rather than wrapping around discovery commercialization or infrastructure leasing, these companies focus on the software wrapper layer of lab automation — orchestrating experiments, exfiltrating data, and providing software analytic wrappers. Rather than building hardware, they offer cloud platforms that sit atop existing lab equipment. For newer entrants in the space, they are often layering in AI for data analysis and workflow optimization.

While valuable, this approach relies heavily on integrating with a fragmented and constantly evolving landscape of vendor-specific hardware, file formats, and APIs. It is unclear what the barrier to entry or competitive moats here are. As a result, competition in this category may hinge less on technical defensibility and more on cloud ecosystem integrations and go-to-market velocity.

Lab-in-a-Box

Example Companies: OpenTrons, ChemSpeed, Trilo Bio, Tecan, Mito Robotics, Flow Robotics, North Robotics, Unchained Labs

Lab-in-a-Box companies sell automation products that individual labs can purchase and deploy onsite. These systems, typically focused on liquid handling, sample prep, or modular automation, allow researchers to configure and run their own workflows locally, without relying on centralized cloud infrastructure. In some cases, this includes enclosed workcells or robot-arm-equipped “lab boxes” that aim to generalize across multiple experimental steps.

The tradeoff is that these systems primarily provide workflow automation, not end-to-end experimental capability. Outside of liquid handling, most units lack integrated synthesis or characterization tools, which researchers must supply and integrate themselves. As a result, users often bear significant responsibility for instrument compatibility, workflow setup, and maintenance, particularly when working outside of standardized applications.

Robotic Experimentalist

Example Companies: Medra AI, Zeon systems

Related to Lab-in-a-Box, these companies build on a stronger thesis about general-purpose robotics. Rather than designing enclosed, task-specific lab systems, Robot Experimentalist startups aim to leverage commercial robotic platforms and train them to directly manipulate existing science instruments and lab environments.

The promise is compelling: bypass the need to redesign every instrument or build a custom box by dropping in a flexible robot that can “learn” how to use existing lab hardware. But it's still unclear whether robotics are yet robust, dexterous, or affordable enough to natively integrate with heterogeneous lab setups. Adoption will likely depend on whether these systems can generalize across workflows, reduce configuration overhead, and hit acceptable cost-performance thresholds. These startups are riding the broader wave of humanoid and general-purpose robotic platforms — their success may hinge less on lab-specific insight and more on timing the maturity curve of this larger technological wave.

Automation-Native Science Instruments

Example Companies: ?

A conspicuous gap in the lab automation startup ecosystem is companies building science instruments designed from the ground up for automation. Most existing startups abstract over the limitations of today’s fragmented instrument landscape. Discovery-as-a-Service (DaaS) and Infrastructure-as-a-Service (IaaS) players integrate around legacy tools, shouldering the cost and complexity themselves. Lab-in-a-Box and ScienceData-as-a-Service models, meanwhile, offload the integration problem to researchers — requiring them to retrofit workflows or wrap software layers around hardware never built for automation in the first place.

The core thesis here is that none of these models fully overcome the brittleness of the underlying hardware ecosystem. IaaS and DaaS companies absorb too much integration debt with inadequate science instruments. Lab-in-a-Box and Lab Orchestration leave critical gaps in synthesis and characterization, and do not fully solve adoption challenges. And general-purpose robotics will not generalize fast or cheaply enough to serve as a universal abstraction layer for all physical labs.

Even if everything in the above paragraph is off-base, the case for purpose-built, automation-native instruments still stands. Every company in this market — from cloud labs to orchestration platforms to robotic experimentalists — would benefit from complementary science instruments that expose robust pythonic APIs and are natively designed to be controlled by autonomous agents.

The challenge here is that it requires new science hardware development. It is a product-based approach, at least initially, and consequently also offers low returns. But I think both of these issues are quite surmountable with the right team and business model. While most startups work around the limitations of today’s instrument ecosystem, this path aims to disrupt it entirely — replacing a legacy industry built for a slower, more manual era of science.

This is a thesis I intend to be exploring more in the coming months – stay tuned!

Note I am not including the wide array of startups building materials discovery models or experimental bayesian optimization, which I do not consider as lab automation.

We see this play out even in the AI race happening today. It is still unclear whether a model developer, like Anthropic, is the right shaped company to capture the value they create. OpenAI is beginning to move towards products, and up and down the tech chain into browsers and chips, while Google is continuing to grow its position as a vertically integrated AI company. Much of the churn in a new technology is coasian in nature and lab automation is no different!

Materials scientist here, your post may be underestimating how difficult it is to make competitive scientific hardware. It is a lot easier for me to see Bruker adding a python API to their x-ray diffractometers (XRDs) than for another company to make an "automation-native" XRD. Goes double for more complex microscopy / optics, maaaybe easier for simpler measurements. I think this should generalize: wherever the existing hardware is relatively high-tech in itself, the incumbents should have an advantage over newcomers in their ability to just add an API.

Great article. Do you have similar information (list) about self-driving labs based in Universities globally?